welcome message

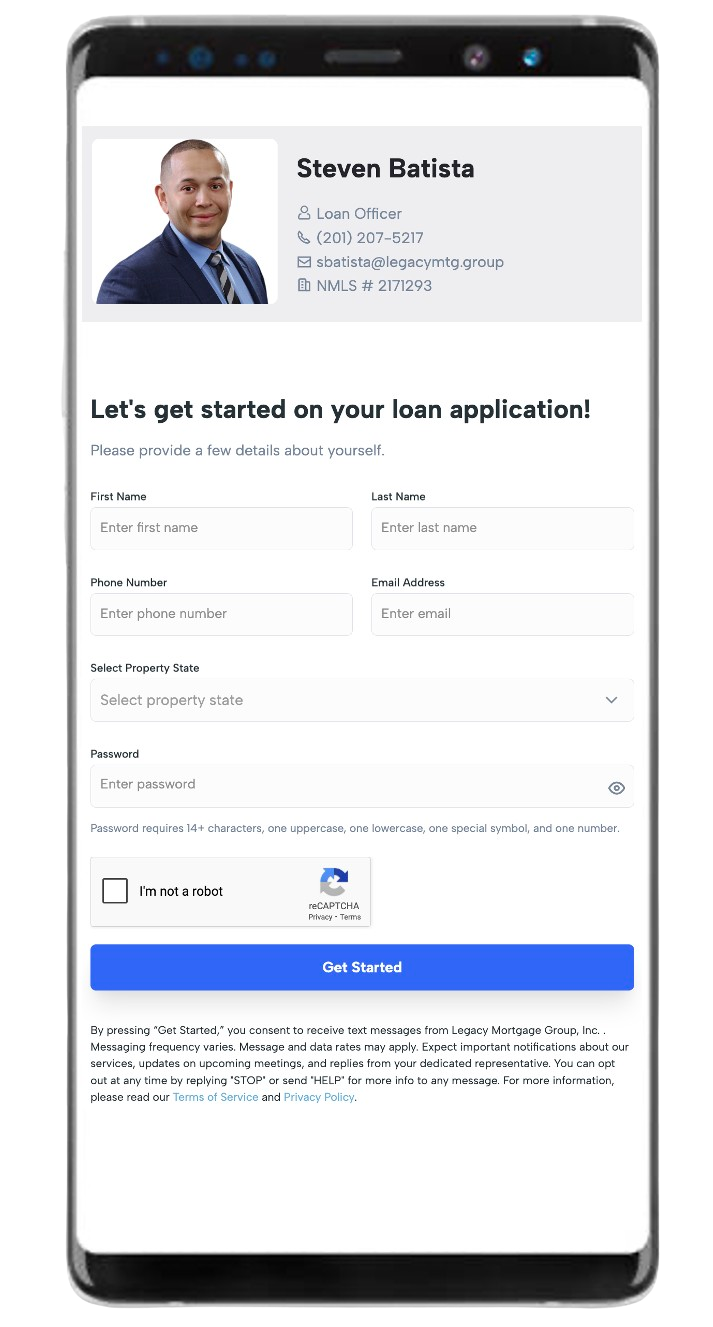

Steven Batista

Legacy Mortgage Group Inc.

Why Choose Steven

As a mortgage loan originator, Steven Batista at Legacy Mortgage Group Inc, will guide you through the home loan process to secure the best financing options. Below are a few services that are offered:

- Personalized loan consultations

- Home purchase financing

- Conventional loans, FHA Loans

- VA Loans, USDA loans

- Non QM Loans

- Refinance options

- Credit and financial counseling

My mission is to raise the bar in the mortgage industry by providing exceptional customer service and a personalized approach to home financing. I’m dedicated to putting the people I serve first, ensuring that you have the information and guidance you need to make informed decisions about your mortgage. My goal is to walk you through the entire home loan process with care, helping you confidently choose the right mortgage for you and your family from a wide range of options available today. Once you select the loan that best suits your needs, I’ll continue working tirelessly on your behalf to make your dream of homeownership a reality.

I aim to be your trusted partner for life. I want to be your first choice every time you need a home loan. I am committed to going above and beyond to ensure your satisfaction. My dedicated service will leave you confident referring your family and friends to me for all their mortgage financing needs.

Take advantage of my extensive experience in the residential lending industry by applying online today. You’ll find that the expertise, professionalism, and personal care I provide, makes your loan experience smooth and rewarding.

Contact Steven Batista at Legacy Mortgage Group Inc today for a free, personalized consultation. You can also apply online—it’s quick, secure, and easy. Thank you!

How To Get Started

Fast & Easy Application Process

As a mortgage loan originator, Steven Batista at Legacy Mortgage Group Inc, will guide you through the home loan process to secure the best financing options. Below are a few services that are offered:

- Personalized loan consultations

- Home purchase financing

- Conventional loans, FHA Loans, VA Loans, USDA loans, Non QM Loans

- Refinance options

- Credit and financial counseling

Contact Steven

Collect Borrower Information

Assess Creditworthiness

Verify Income and Assets

Evaluate Debt-To-Income Ratio (DTI)

Loan Pre-Approval

Submit To Underwriting

Close The Mortgage Loan

Ensure all required documentation is submitted and verified

Confirm that borrower has proof of Home Owners Insurance.

Confirm that borrower has proof of and title insurance.

Schedule a closing date and time for signing the

final paperwork.

Prepare closing disclosure, outlining the loan costs, fees and adjustments.

Review the closing statement with the borrower to ensure accuracy.

Borrower signs mortgage documents, loan

agreement & promissory note.

Transfer funds (down payment, closing costs) as per the agreed terms.

Lender funds the loan, and the mortgage is recorded with the county.